HST to apply to new home construction

Genworth Canada provided this great synopsis about the impact the new Harmonized Sales Tax (HST) will have on construction financing and what new home buyers can do to access the government’s HST rebate program.

Effective July 1, 2010, the province of Ontario will be combining the GST and PST taxes into one Harmonized Sales Tax (HST). The implementation of the HST will not change the taxation on mortgage insurance premiums. However, the HST will be applicable on new construction homes and may be eligible for the HST new housing rebate. For qualification and submission purposes, the lender is not required to deduct the rebate from the purchase price. The lender may submit the total purchase price exclusive of any rebates. The following general provisions will apply.

In Ontario, the HST rate on new construction housing (i.e. both house and land) will be 13% (GST of 5% and PST of 8%)

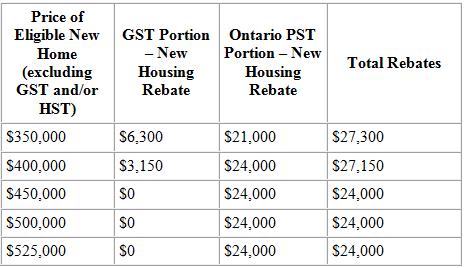

There will be a partial rebate of the provincial portion of the HST in an amount equal to 6% of the purchase price up to a maximum rebate of $24,000.00. The rebate would reduce any tax increase on new housing sold for a purchase price of up to $400,000.00. There would be no phase out of this rebate, such that homes priced above $400,000 would qualify for the maximum rebate amount of $24,000.

New home buyers may be eligible for the federal GST new housing rebate, which generally equals 36% of the tax paid on the first $350,000 of the purchase price. The amount of the GST rebate is phased out on a straight-line basis for homes priced between $350,000 and less than $450,000.

Examples of the applicable taxes are as follows:

Notes: for specific information regarding the HST, please refer to the Canada Revenue Agency and/or the Ontario Ministry of Finance.

BACK TO BLOG FEED